Current Market Factors: Why Did Costco Stock Drop Today

Why did costco stock drop today – Costco’s stock performance is influenced by various current market conditions. The overall market sentiment, economic events, industry trends, and news play a significant role in shaping the stock’s value.

The recent economic slowdown, rising inflation, and interest rate hikes have created uncertainty in the market. Consumers are becoming more cautious about spending, which may impact Costco’s sales and profitability. Additionally, supply chain disruptions and labor shortages continue to pose challenges for the company.

Today’s Costco stock drop may have been influenced by a combination of factors, but one notable distraction has been the unveiling of the new Pennsylvania license plate design. While the sleek and modern look of the plate has garnered attention, it’s unclear whether the stock market will react positively to this news.

Nevertheless, Costco’s fundamentals remain strong, and investors should keep a close eye on the company’s upcoming earnings report for further insights into its financial performance.

Industry Trends, Why did costco stock drop today

The retail industry is undergoing significant changes, with the rise of e-commerce and changing consumer preferences. Costco faces competition from both traditional brick-and-mortar retailers and online marketplaces. The company’s ability to adapt to these trends and maintain its competitive advantage will be crucial for its future success.

News and Events

Recent news and events can also impact Costco’s stock price. For example, positive earnings reports or announcements of new store openings can boost investor confidence and drive up the stock price. Conversely, negative news, such as product recalls or lawsuits, can have the opposite effect.

Costco stock took a tumble today, leaving investors scratching their heads. While the reasons for the decline are still unclear, some analysts have speculated that it may be due to a recent announcement regarding the new PA license. The new license requirements have raised concerns among investors about the potential impact on Costco’s bottom line.

However, it is important to note that the stock market is volatile and it is possible that Costco’s stock price will rebound in the coming days.

Company-Specific Factors

Costco’s recent financial performance, operational changes, and industry dynamics have significantly impacted its stock price.

Examining these factors provides insights into the company’s overall health and its potential for future growth.

Financial Performance

- Revenue: Costco has consistently reported strong revenue growth, driven by increased membership fees and sales volume.

- Expenses: Operating expenses have risen due to labor costs, supply chain disruptions, and investments in technology.

- Profitability: Net income and profit margins have remained relatively stable despite rising expenses.

Operational Changes

- Expansion: Costco has continued to expand its store footprint, both domestically and internationally.

- E-commerce: The company has invested heavily in e-commerce to complement its physical stores.

- Membership fees: Costco increased its annual membership fee in 2022, contributing to revenue growth.

Competition and Industry Dynamics

- Competition: Costco faces intense competition from other retailers, including Walmart, Target, and Amazon.

- Inflation: Rising inflation has impacted Costco’s costs and consumer spending patterns.

- Supply chain: Supply chain disruptions have affected Costco’s inventory levels and profitability.

Technical Analysis

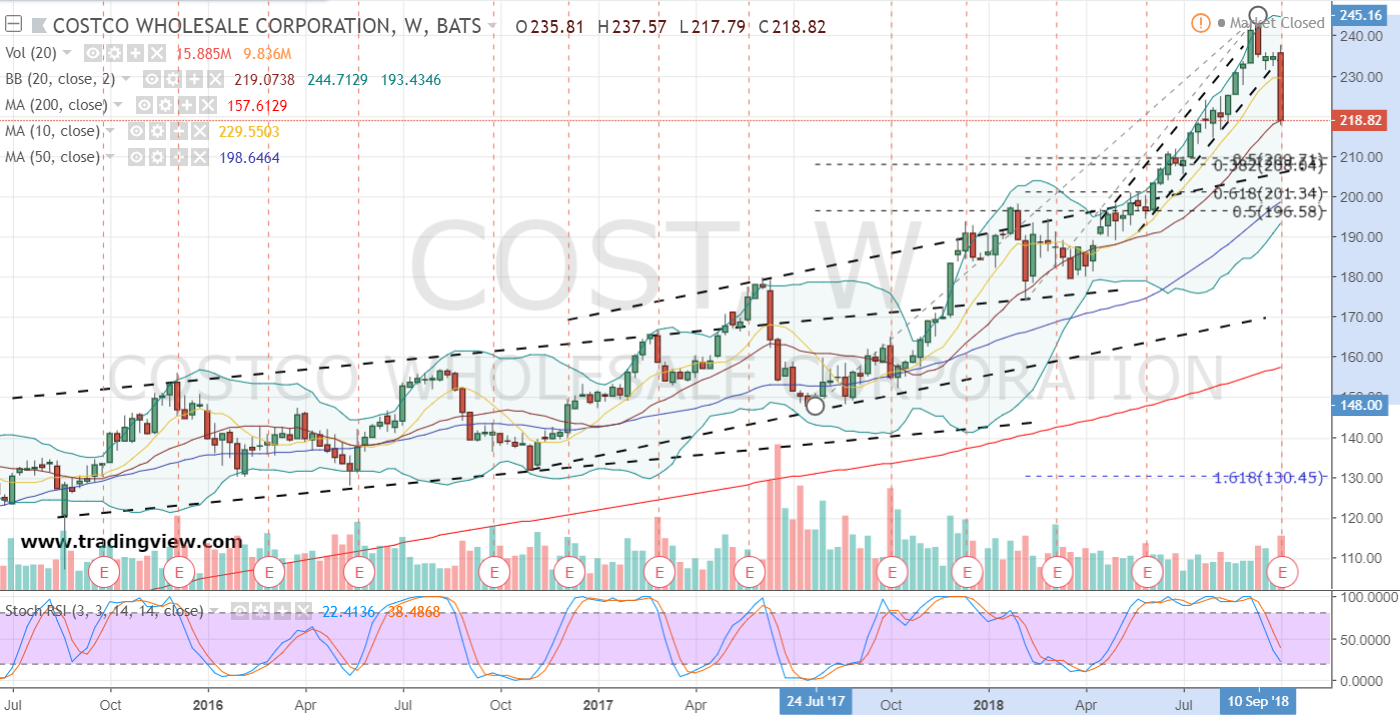

Costco’s stock chart reveals key support and resistance levels that provide insights into potential price movements. Recent price patterns, trends, and indicators suggest potential opportunities for traders.

Support and Resistance Levels

Costco’s stock has established a key support level at $500, which has held strong during recent market downturns. The resistance level at $550 has capped upward price movements, indicating a potential area of profit-taking.

Price Patterns and Trends

Costco’s stock has been trading within a sideways trend, with prices oscillating between $500 and $550. A breakout above $550 could signal a bullish trend, while a breakdown below $500 could indicate a bearish reversal.

Indicators

Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest that Costco’s stock is currently in a neutral zone. However, the RSI is approaching overbought territory, indicating potential for a pullback.

Volume and Volatility

Trading volume has been relatively low in recent weeks, indicating a lack of market interest. However, volatility has been increasing, suggesting that a breakout or breakdown could be imminent.